Yearning for earnings? Check out Public.com, the investing platform for serious traders. You can build a multi-asset portfolio of stocks, bonds, options, crypto, and more. Access industry-leading yields like the 4.1% APY* so you can earn on your cash with no fees or minimums.

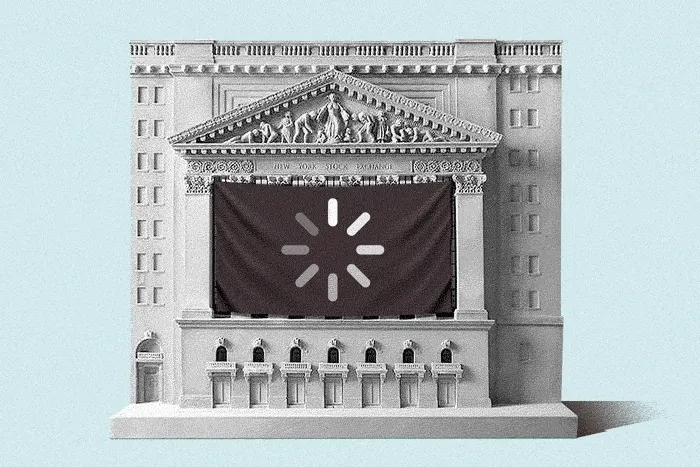

You may think that with the stock market consistently hitting fresh record highs, the number of public companies listed has climbed the charts in tandem.

But that’s not the case. In fact, the number of public companies listed on US exchanges reached a peak in 1997—and that number has been declining since.

We’ve written about the resurgence in the IPO market, with splashy debuts from former unicorns like CoreWeave, Circle, and Figma. But while that may make it seem like there’s a healthy pipeline of private companies that want to go public, there’s a deeper trend that’s concerning experts like Reena Aggarwal, professor of finance at Georgetown’s business school.

Although the US has the biggest stock market by market cap, the nation has the fourth most publicly listed companies, lagging behind China, the EU, and Japan. While the number has zig-zagged over the years, dropping sharply with the dot com bust and spiking during the SPAC boom of 2023, there are now roughly 3,838 public companies in the US, according to Aggarwal. That’s down from 7,522 public companies in 1997.

Why does this matter? “Public markets play a really important role in the financial economics and competitiveness of a country,” Aggarwal explained in an interview with Brew Markets. That’s why Aggarwal recently published a paper on the very topic.

She isn’t the only one who's noticed: Everyone from JPMorgan CEO Jamie Dimon to leading economists are worried that companies are putting off their public debut—or just staying private permanently.

Why fewer companies are going public

One obvious reason firms are choosing to stay private longer: There’s more private capital ready to be deployed than ever before. “Why do I want to be a public company if I can get private capital easily, quickly, and at good terms?” explained Aggarwal.

That sweet, sweet shareholder money doesn’t hold the same allure these days, either. Companies are exploring new ways to open private companies to public funding, whether that’s Robinhood offering tokenized shares of OpenAI and SpaceX, or JPMorgan expanding its research coverage to private companies.

Aggarwal also pointed to regulatory requirements, threats of litigation, and the rise of shareholder activism—just to name a few of the reasons companies are hesitating to hit the public market.

In short: If the funding is available, it's just plain easier to be a private company these days.

Her suggestions for policies that would encourage more companies to go public get at that very idea—if it's less expensive and onerous to be listed on a US exchange, more firms will jump in the public market waters. Some of the recommendations she proposed include limiting disclosures and regulatory requirements, and streamlining the proxy voting process to make it more efficient.

Or, maybe just the prospect of being named in Brew Market’s movers and groovers section will be motivation enough.—LB